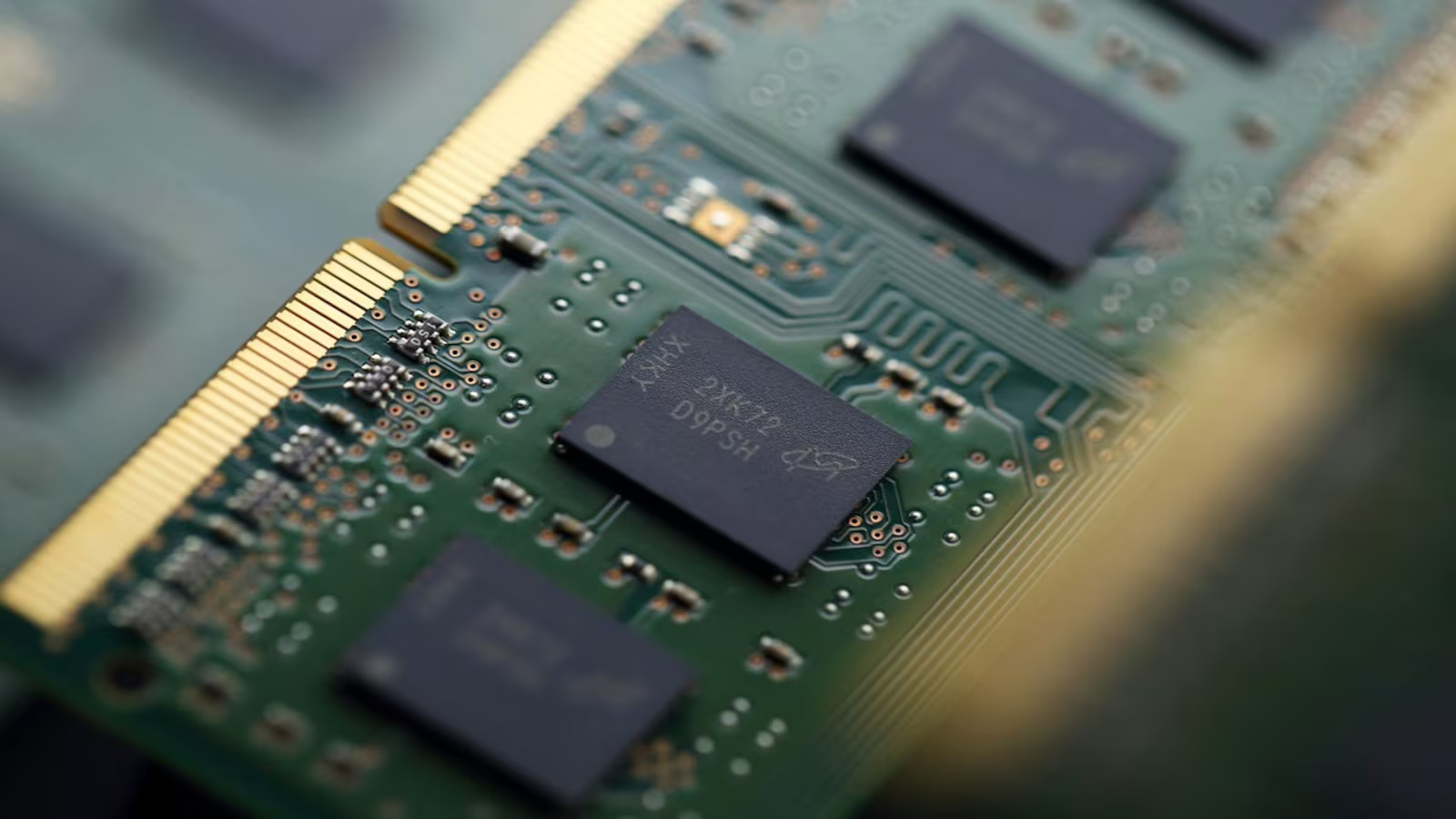

Shares of Micron Technology experienced a significant surge of 15.7% in premarket trading following the company’s unexpected profit announcement and a forecast of third-quarter revenue surpassing Wall Street estimates. The rise in stock value, with shares reaching $111.43, indicated a potential record high at market open.

Micron attributed its success to the high demand for its high bandwidth memory (HBM) chips, important components in AI computing applications. The company disclosed that its HBM chips had sold out for the entirety of 2024, anticipating a positive impact on gross margins in the upcoming quarter.

The forecasted revenue for the third quarter stands at $6.60 billion, with a margin of $200 million, surpassing market estimates. Similarly, Micron expects an adjusted gross margin of 26.5%, surpassing the market consensus of 20.8%.

Analysts attribute Micron’s success to the confluence of tight supply, increasing demand, and a reduction in excess inventory, particularly in the HBM market.

The company’s partnership with Nvidia, a prominent player in AI computing, for the latest HBM chips underscores Micron’s position in the market.

Micron’s performance serves as an essential indicator of demand trends within the semiconductor industry. Investors and analysts closely monitor Micron’s results as a gauge of the overall chip demand and market sentiment.

Mark Haefele, chief investment officer at UBS Global Wealth Management, predicts a robust recovery in the semiconductor industry, fueled by the increasing adoption of AI technologies.

Micron’s positive outlook contributes to the overall optimism in the sector, reflected in the surge of peer companies’ stock values.

Micron’s favorable results have caused the shares of other chipmakers, including Western Digital, Nvidia, Qualcomm, Intel, Broadcom, and Marvell Technology, to experience notable gains, along with a 2.4% increase in the iShares Semiconductor ETF.