Shares of Snap, the parent company of Snapchat, tumbled on Tuesday following its announcement of a loss in the last quarter of 2023.

Snap reported a net loss of $248 million for the December quarter, a slight improvement from the same period the previous year but narrower than what Wall Street analysts had anticipated. Despite this, shares plummeted by around 30% in after-hours trading on Tuesday.

The company also disclosed that revenue for the quarter had grown by 5% year-over-year to $1.36 billion, marking its second consecutive quarter of revenue growth after experiencing declines in the preceding two quarters of 2023.

However, Snap acknowledged in a letter to investors that the conflict in the Middle East had posed challenges, contributing to a “headwind to year-over-year growth of approximately 2 percentage points in Q4.”

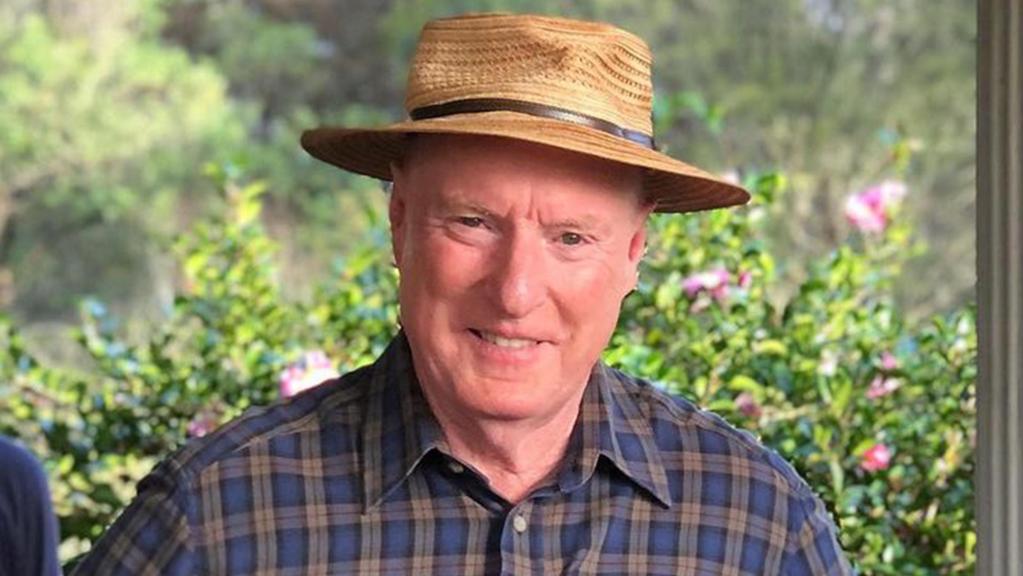

CEO Evan Spiegel sought to maintain an optimistic outlook in the company’s earnings release, noting that 2023 had been a transformative year for Snap. He highlighted efforts to enhance the advertising business and expand the global community, which now boasts 414 million daily active users.

Nevertheless, the earnings report followed a recent announcement that Snap would be reducing its workforce by 10%, resulting in approximately 500 job cuts. This move indicates ongoing cost-saving measures, particularly after the company laid off 20% of its staff in 2022 and an additional 3% last year.

Thomas Monteiro, a senior analyst at Investing.com, commented that the layoffs seemed necessary based on the reported numbers. He suggested that Snap needs to reassess its strategy, particularly regarding monetization.

Investors may have been disappointed with Snap’s results, especially compared to rival platform Meta’s significant profit growth for the same period, which was reported the previous week. Meta’s success signaled an overall improvement in the digital advertising market.

Snap has been striving to enhance its advertising technology and offerings following changes in Apple’s app tracking policies in 2021, which impacted the business models of various platforms, including Snapchat and Facebook.

Spiegel emphasized Snap’s progress in ad-targeting efforts during the earnings call, citing a 20% year-over-year increase in the number of small and medium-sized advertisers.

Despite the challenges, Snap announced positive developments such as the growth of its Snapchat+ subscription program to over 7 million subscribers and strong user growth, with daily active users reaching 414 million in the December quarter.

Looking ahead, Snap anticipates continued user growth in the current quarter, projecting an increase to 420 million daily active users. The company also expects year-over-year revenue growth of 11% to 15% for the first three months of 2024.

In addition to addressing financial performance, Snap is also focused on rebranding efforts to differentiate itself from other social media platforms. A new brand campaign, “Less Social Media. More Snapchat,” aims to highlight the platform’s emphasis on personal communication over passive content consumption.

The launch of this campaign coincided with Spiegel’s appearance at a Senate hearing focused on platform safety measures for young users, where he expressed apologies to parents affected by incidents involving Snapchat.