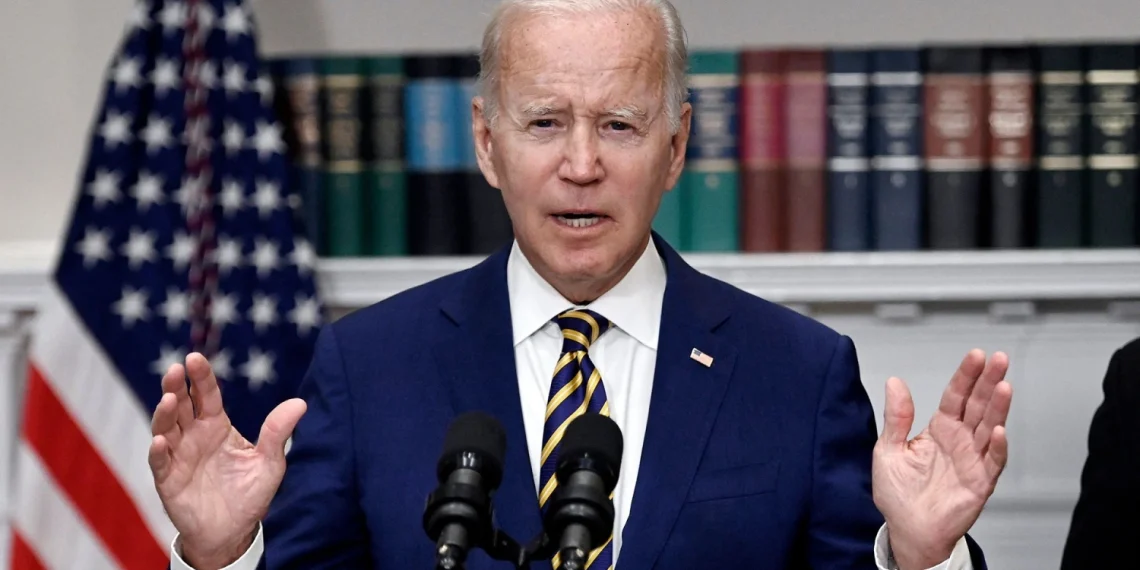

A federal judge in Texas has halted the implementation of new regulations proposed by the Biden administration, which aimed to revamp lending practices for low- and moderate-income Americans.

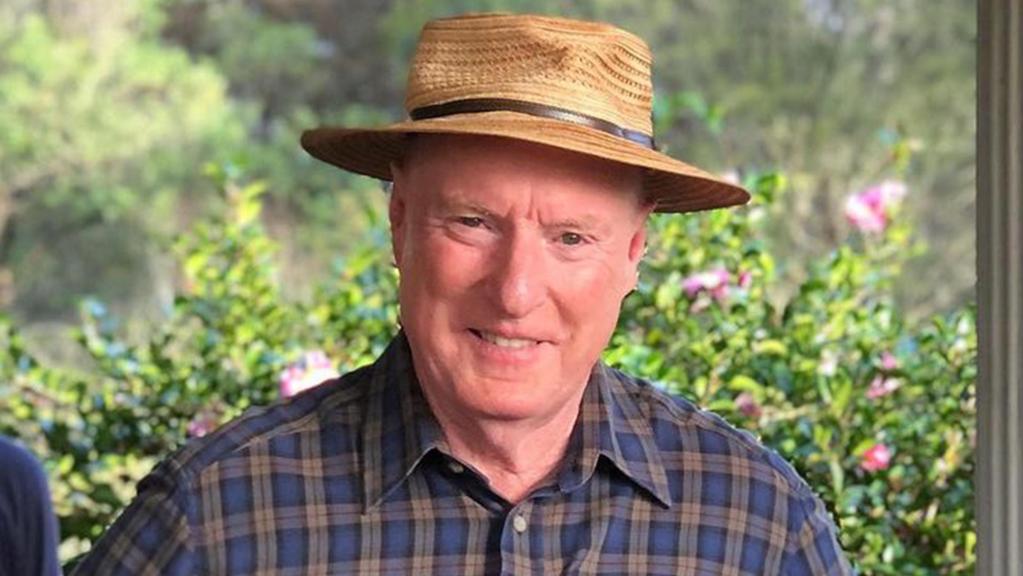

The U.S. District Judge Matthew Kacsmaryk, based in Amarillo, Texas, granted a preliminary injunction following a lawsuit brought by banking and business organizations, including the American Bankers Association and the U.S. Chamber of Commerce. These groups argued that the regulations violated the Community Reinvestment Act of 1977.

The regulations, proposed by the Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency, sought to update enforcement rules for the 1977 fair lending law.

The law was designed to prevent discriminatory practices like redlining, where banks limit lending to certain areas or demographics, particularly minorities.

The proposed changes expanded the areas where lenders were required to provide services to low-income individuals, reflecting the shift towards online banking and the decline of physical branches.

Judge Kacsmaryk sided with the plaintiffs, stating that the new regulations exceeded the authority granted by the 1977 law.

He highlighted concerns over the broadened scope of assessment criteria, which included areas beyond where banks maintained physical branches and evaluated the availability of deposit products, not just credit, in communities.

This decision marks a setback for the Biden administration’s efforts to reform financial regulations. Judge Kacsmaryk’s role as the sole active judge in Amarillo has made his courthouse a preferred venue for conservative litigants challenging federal policies.

He gained attention last year for suspending the approval of the abortion pill mifepristone, a case currently under consideration by the U.S. Supreme Court.