Chipmaker Nvidia has emerged as the most traded stock on Wall Street, outpacing Tesla and emphasizing the growing importance of AI investments to investors.

This shift in dominance underscores the potential risks for investors should Nvidia fail to meet its high revenue growth expectations, which could dampen the momentum of the broader market rally driven by optimism surrounding artificial intelligence.

Nvidia’s remarkable rise in daily trading volume, averaging $30 billion, has propelled it ahead of Tesla, which had previously dominated Wall Street trading since 2020. This surge in trading activity reflects the significant role that Nvidia plays in the market and highlights the heightened interest among investors in AI-related companies.

The quarterly earnings report from Nvidia, scheduled for Wednesday, is highly anticipated by investors and analysts alike. Many strategists believe that anything short of exceptional results could lead to a reversal in Nvidia’s soaring stock price, which has already surged by 47% in 2024.

This suggests that there is considerable pressure on Nvidia to deliver strong financial performance and meet or exceed market expectations.

On the other hand, Super Micro, a company benefiting from the AI boom as it supplies server components to Nvidia, has seen its stock value triple to $45 billion so far in 2024.

However, this rapid ascent was tempered by a 20% drop in stock price after Wells Fargo initiated coverage with an equal weight rating, cautioning that the stock’s valuation already accounts for substantial upside potential.

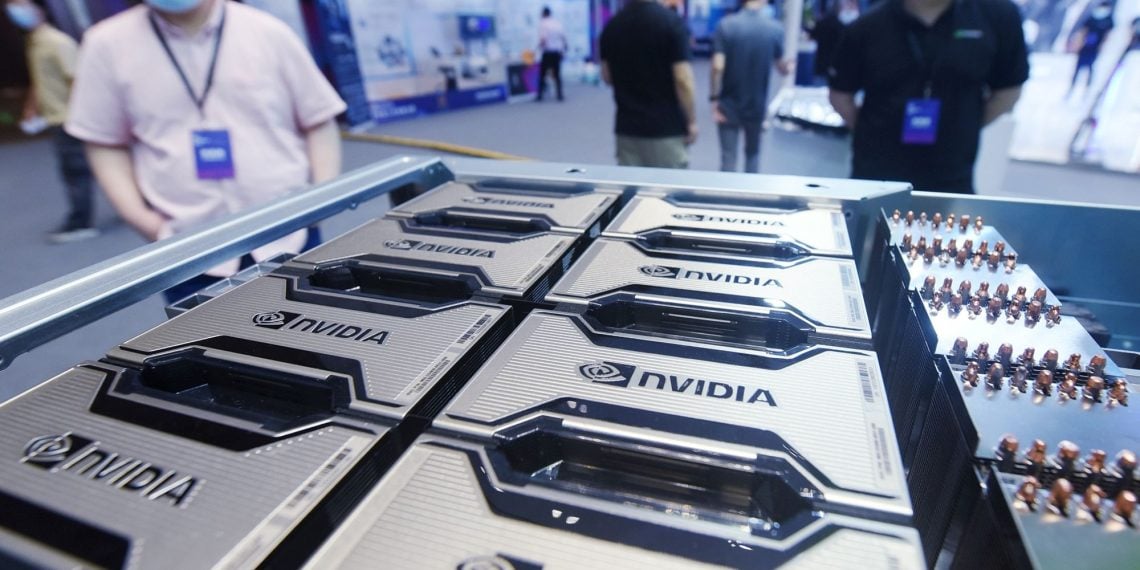

The dominance of Nvidia in the high-end AI chip market is further underscored by its market capitalization, which now exceeds that of tech giants like Amazon and Alphabet, making it the third most valuable company on Wall Street.

This meteoric rise in market value, from $540 billion to $1.8 trillion in just a year, solidifies Nvidia’s position as a key player in the AI industry and reflects investors’ growing confidence in its future prospects.