UK equities surged alongside global markets, with the FTSE 100 index rising by 0.7%, reflecting optimism spurred by positive indicators such as the slowdown in US inflation.

This uptick follows a rally on Wall Street, driven by the release of data showing the smallest annual increase in inflation in three years, fueling hopes of a potential rate cut by the Federal Reserve.

Investor sentiment was further boosted by robust performances in sectors sensitive to interest rates, such as real estate investment trusts and telecommunications, which saw notable gains of 1.7% and 1.9%, respectively.

The market also responded positively to comments from investment managers, who noted a sense of buoyancy stemming from expectations of a stable interest rate environment.

Among individual stocks, Pearson saw a significant uptick of 4.8% after meeting market expectations for its 2023 operating profit, which surged by 31% on an underlying basis.

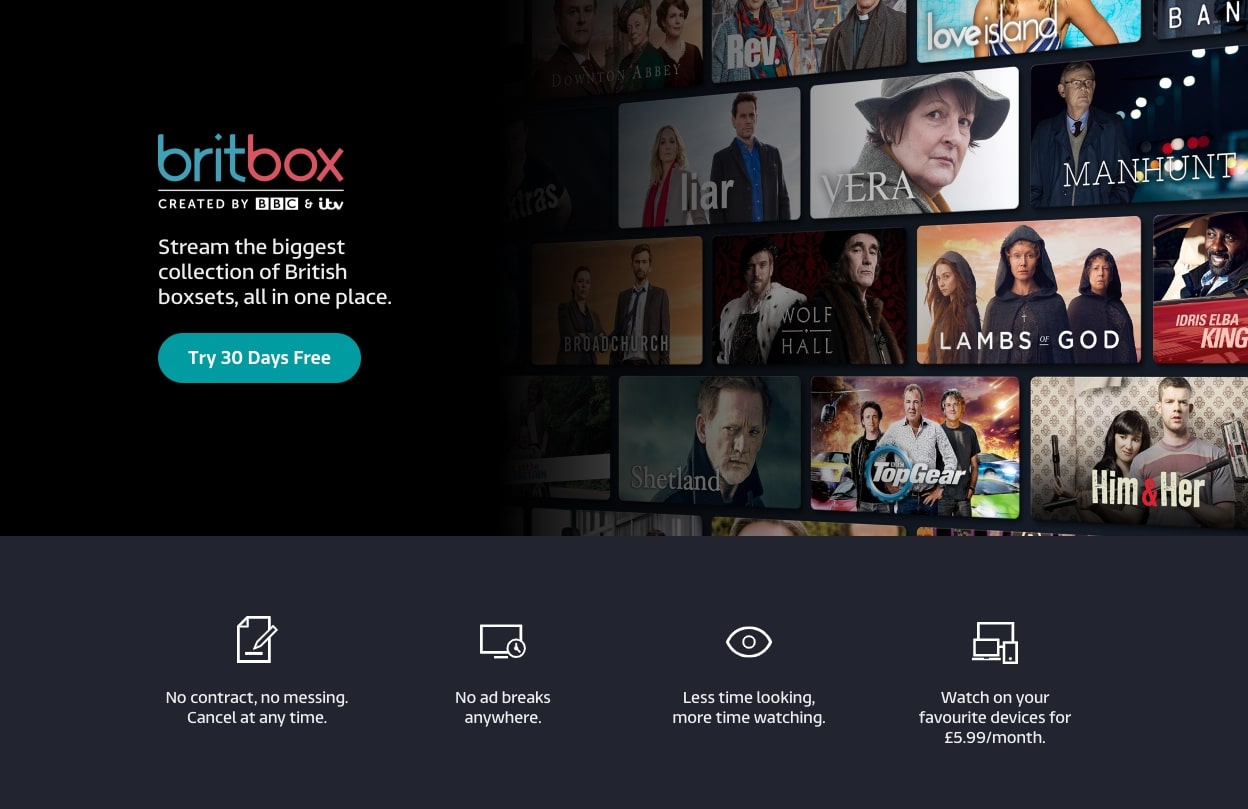

Similarly, ITV experienced a remarkable 14.3% increase following the sale of its entire stake in BritBox International to BBC Studios for £255 million ($322.09 million).

However, Rightmove faced a downturn of 4.4% amid uncertainties, particularly regarding projected customer reductions in the coming year. This decline underscored ongoing challenges in the property sector amidst macroeconomic uncertainties.

Looking ahead, investor focus is expected to shift towards the upcoming budget announcement by Finance Minister Jeremy Hunt, where potential tax cuts are anticipated against the backdrop of escalating national debt.

Additionally, positive signs emerged from Nationwide’s report indicating the first annual increase in UK house prices in over a year, signaling potential recovery in the housing market.