President Joe Biden‘s proposed U.S. government budget aims to increase tax revenues by $4.951 trillion over the next decade, primarily through tax hikes targeting businesses and wealthy individuals, according to the U.S. Treasury.

The budget also includes an additional $104.3 billion in mandatory funding for the Internal Revenue Service (IRS), with estimates suggesting this could generate an additional $341 billion in revenues over the same period.

Reforms to international business taxation, influenced by a global minimum tax deal, are projected to contribute $632.2 billion to U.S. receipts. Additionally, proposed measures such as raising the domestic large-company minimum tax and limiting deductions for executive compensation are expected to bolster revenue further.

Tax increases focused on affluent individuals, including the introduction of a “billionaire tax,” are forecasted to generate $1.96 trillion. There’s also an emphasis on enhancing tax compliance among high-income earners through increased IRS funding.

The budget outlines new housing-related tax proposals, such as tax credits for first-time homebuyers and sellers, which are estimated to cost $47.3 billion over the next decade. Furthermore, broader tax reforms aimed at assisting moderate-income families would necessitate $764.9 billion in funding.

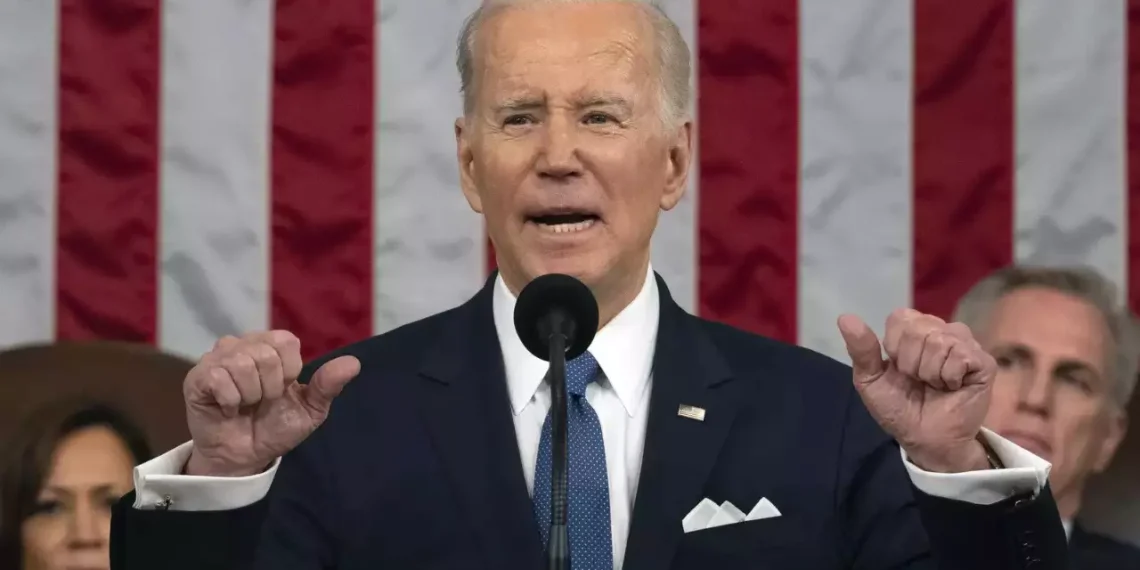

Despite facing resistance in Congress, Biden’s budget plan forms a key element of his election-year strategy, emphasizing tax fairness and fiscal responsibility.

The proposed tax increases on businesses and the wealthy are positioned as essential for funding new programs to assist low- and middle-income Americans, particularly in areas such as housing and childcare.