President Joe Biden’s administration continues to address the burden of student debt despite setbacks. Since taking office, nearly $138 billion in federal student loans has been canceled, benefiting almost 3.9 million borrowers.

The latest relief effort focuses on those enrolled in the SAVE (Saving on a Valuable Education) repayment plan, introduced as pandemic-related payment pauses ended.

Under the SAVE plan, borrowers who initially borrowed $12,000 or less and made payments for at least 10 years will see their remaining federal student loan balances erased. This initiative is expected to impact nearly 153,000 borrowers, totaling about $1.2 billion in canceled debt.

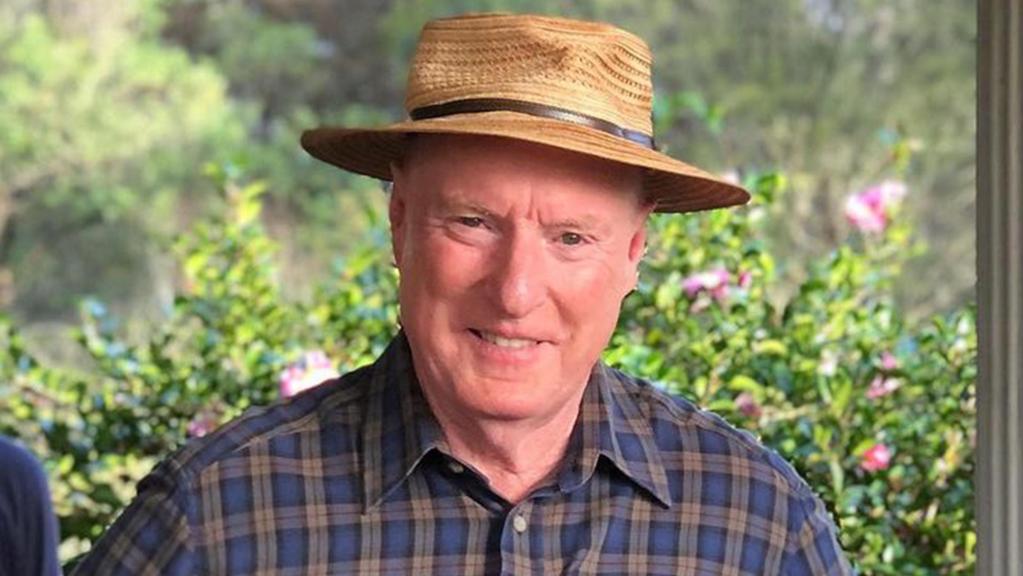

The announcement is accompanied by a congratulatory message from President Biden, underscoring his commitment to easing the financial burden of higher education.

Additionally, the Biden administration is conducting a one-time recount of borrowers’ past payments to rectify administrative errors. This measure aims to ensure borrowers receive the forgiveness entitled to them, addressing historical difficulties in accurately tracking payments.

The recount is particularly beneficial for borrowers who were mistakenly directed into long-term forbearance periods, halting their progress toward debt relief.

Furthermore, efforts to expand existing debt relief programs are underway. The Public Service Loan Forgiveness (PSLF) program, designed to assist public-sector workers, has seen eligibility expansions and retroactive credit for qualifying payments.

Similarly, strides have been made in processing borrower defense claims for individuals defrauded by for-profit colleges.

The Biden administration’s initiatives reflect a commitment to easing the financial strain on student borrowers and promoting equitable access to higher education. Despite legal challenges, the administration remains steadfast in its efforts to alleviate student debt burdens and provide relief to millions of borrowers across the country.