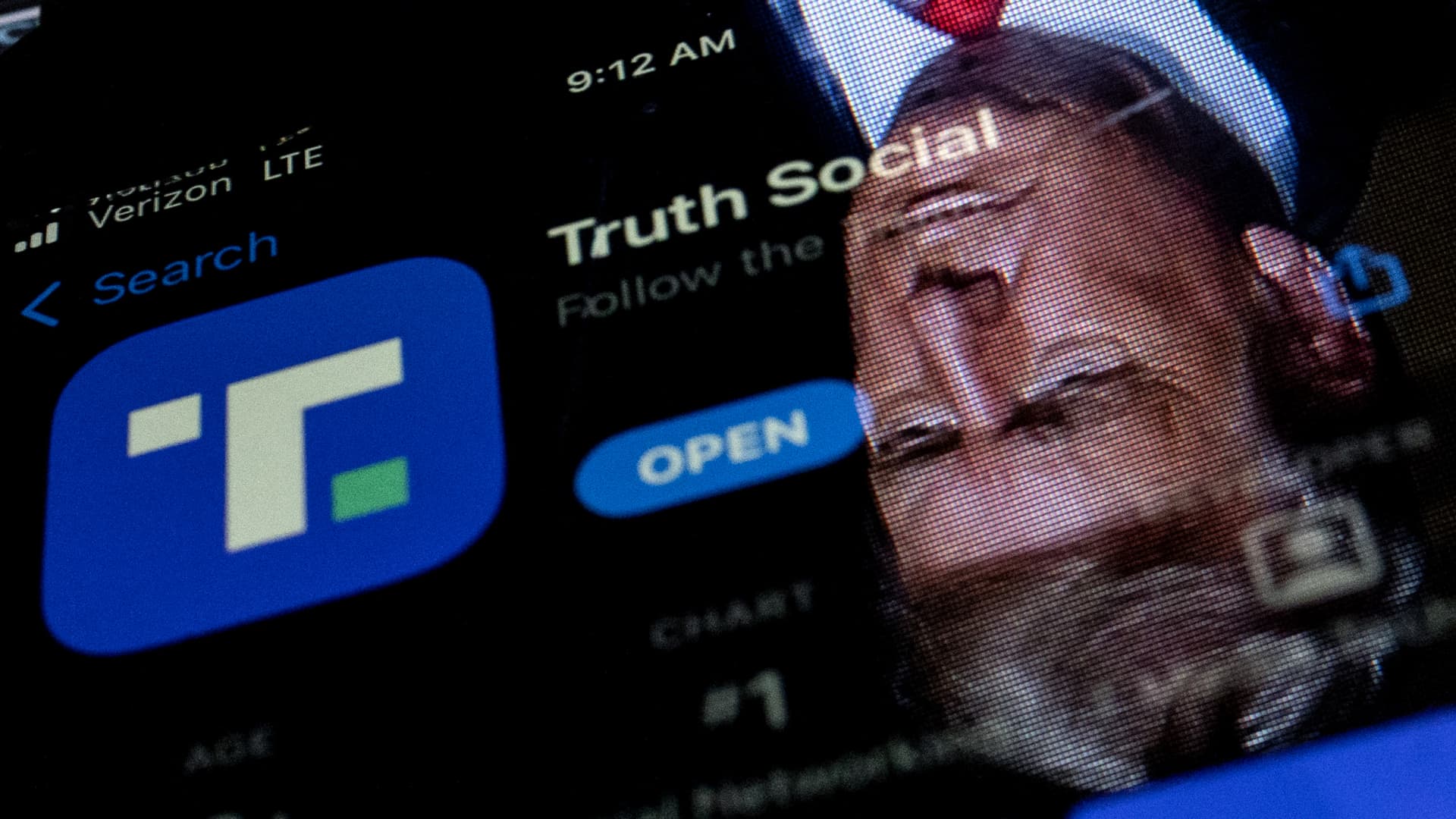

Shares of Trump’s social media venture plummeted 21% on Monday, erasing gains from its recent debut, as financial disclosures revealed significant losses and future financial concerns.

Trump Media & Technology Group reported a loss of over $58 million in 2023, prompting a sharp decline in share value just days after its high-profile public offering through a blank-check merger.

The stock had initially surged during its March 26 debut, closing at nearly $58 per share, driven by retail buyer enthusiasm, including supporters of Donald Trump.

Monday’s disclosure of substantial losses reversed the upward trend, sending shares tumbling by 21% to $48.66.

Analysts attribute the stock’s decline to overvaluation and doubts about Truth Social’s path to profitability. Ross Benes from Insider Intelligence notes that the service lacks clear revenue streams, making its high debut unsustainable.

Despite the drop, Trump’s significant ownership stake of 78.75 million shares could still yield substantial gains, albeit less than initially anticipated. His shares, valued at over $6 billion at peak, now stand around $3.8 billion following the selloff.

However, Trump is restricted from selling or leveraging his shares for six months, a move that could prompt further selling if attempted.

Although the stock’s market value still exceeds $6 billion, comparisons with established platforms like Reddit, with an $8 billion market capitalization, highlight Truth Social’s challenges in becoming a significant social media contender. Analysts emphasize the platform’s distance from established giants like Twitter, Instagram, and TikTok.

Short sellers targeting Trump Media and its predecessor, Digital World Acquisition, saw significant gains from Monday’s selloff, cutting year-to-date losses. Demand for shorting Trump’s venture remains high, though supply is scarce.

Despite revenue growth to $4.13 million in 2023, up from $1.47 million in 2022, Truth Social’s performance lags behind industry standards. The company’s reluctance to disclose key metrics further fuels skepticism about its market viability.

Trump Media also faces legal disputes with co-founders Wesley Moss and Andrew Litinsky, complicating its operational environment.

A Delaware judge has called for hearings to resolve ownership disputes, underscoring the challenges ahead for Trump’s social media endeavor.