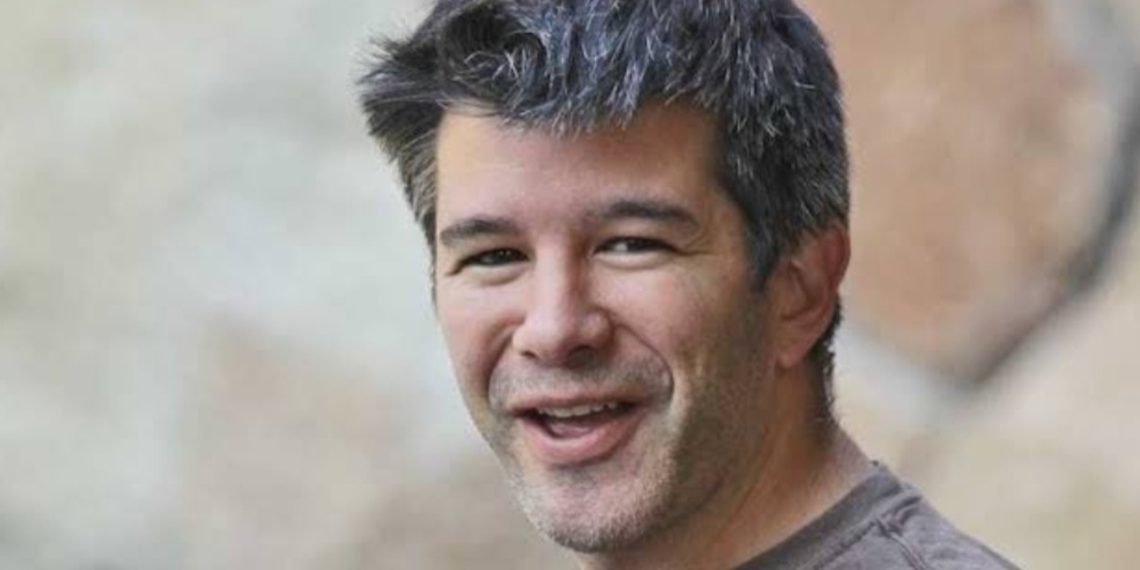

Travis Kalanick, the co-founder of Uber, has seen his net worth skyrocket over the years due to his involvement in one of the most disruptive companies in recent history. As we look ahead to 2025, Kalanick’s net worth is estimated to be a staggering $2.6 billion.

This wealth is primarily attributed to his ownership stake in Uber, his other investments, and his ventures in real estate.

However, Kalanick’s financial journey has not been without challenges, with fluctuations in the stock market, business controversies, and changes in the tech landscape.

Financial Background

Travis Kalanick’s financial story is inextricably linked to his co-founding of Uber in 2009, a company that revolutionized the ride-sharing industry.

Uber’s impact on global transportation, as well as its expansion into food delivery (Uber Eats) and freight services (Uber Freight), has significantly contributed to Kalanick’s wealth.

However, his financial empire also extends beyond Uber, as he has invested in a range of businesses, including real estate and various startup ventures.

The Early Days and the Birth of Uber

Kalanick’s entrepreneurial journey began long before Uber. He was involved in a number of tech startups, such as Scour, a peer-to-peer file-sharing company, and Red Swoosh, an enterprise content delivery company.

Though neither of these ventures reached the scale of Uber, they provided Kalanick with valuable experience that would lay the groundwork for his future success.

Uber, founded in 2009 alongside Garrett Camp, emerged from Kalanick’s vision of disrupting the traditional taxi industry with a mobile app-based platform that connected passengers with drivers.

The company’s rapid growth and scalability helped Kalanick amass a fortune that catapulted him into the billionaire ranks.

Uber’s Rapid Growth and Kalanick’s Wealth Surge

The rise of Uber has been nothing short of spectacular. The company quickly expanded to international markets and diversified its business model to include food delivery services through Uber Eats, as well as freight logistics via Uber Freight. This diversification helped increase Uber’s valuation over time.

At its peak, Uber was one of the most highly valued private companies in the world, with a valuation exceeding $70 billion.

Kalanick, who held a significant stake in the company, saw his wealth grow exponentially. Even before Uber went public in 2019, Kalanick had become a billionaire thanks to the value of his shares in the company.

While Uber’s IPO did not live up to the high expectations many had, Kalanick’s financial success was already solidified.

Net Worth

As of 2025, Travis Kalanick’s estimated net worth stands at $2.6 billion. This number takes into account the value of his remaining shares in Uber, his other investments, and his real estate holdings.

Despite selling off a significant portion of his Uber shares during the company’s IPO, Kalanick has retained a considerable stake in the ride-hailing giant.

While Kalanick’s wealth continues to fluctuate with the stock market and the performance of Uber, he has diversified his financial portfolio in ways that help buffer against any downturns in the tech sector.

The Impact of Uber’s IPO

Uber’s IPO in 2019 marked a significant turning point for Kalanick’s financial trajectory. While the IPO was not as successful as many had hoped—Uber’s stock price initially dropped post-IPO—it still provided Kalanick with a chance to cash out a portion of his shares.

At the time of the IPO, Kalanick owned about 8.6% of Uber, translating to several billion dollars in wealth.

Even though Kalanick sold a portion of his shares, he retained a substantial stake in Uber, ensuring that his wealth would continue to be tied to the company’s future growth. As Uber continues to grow, so too does Kalanick’s fortune.

Post-Uber Ventures and Investments

After stepping down from his role as Uber’s CEO in 2017, Kalanick transitioned into an investor and entrepreneur.

He founded 10100, a venture fund that focuses on investments in emerging markets, real estate, e-commerce, and technology.

This fund has made significant investments, particularly in China and India, where Kalanick sees great potential for growth.

In addition to 10100, Kalanick became heavily involved in CloudKitchens, a startup that provides commercial kitchen space for food delivery companies.

This venture capitalized on the rise of food delivery services and has been a major part of Kalanick’s post-Uber portfolio.

Real Estate Portfolio

Real estate has also played a major role in Kalanick’s wealth-building strategy. One of his most notable purchases was a $36.5 million penthouse in New York City, showcasing his taste for luxury properties.

Kalanick has also made real estate investments through his 10100 venture fund, which targets properties in high-growth regions.

While Kalanick’s real estate investments are both personal and part of his broader business strategy, they serve as a hedge against the volatility of the tech sector and help solidify his wealth.

Philanthropy and Social Impact

Kalanick is also known for his philanthropic efforts, particularly in the realm of education and social causes. He signed The Giving Pledge, a commitment by billionaires to donate at least half of their wealth to charitable causes.

His philanthropic endeavors are a reflection of his broader impact on society, extending beyond the tech industry.

Kalanick’s contributions to various social initiatives show a side of him that values giving back and making a positive impact in the world. As he continues to build his fortune, it’s likely that his philanthropic efforts will increase.

Personal Finance Philosophy

Kalanick’s wealth is a result of his innovative approach to business, but also his personal finance philosophy.

A key aspect of his success has been his ability to diversify his investments, which helps protect his wealth from the fluctuations of any one industry.

By maintaining equity stakes in Uber, launching new ventures like CloudKitchens, and investing in real estate, Kalanick has built a financial portfolio that balances risk with long-term potential.

Market Fluctuations and the Tech Industry’s Influence

As a tech entrepreneur, Kalanick’s wealth is subject to market conditions, especially the performance of Uber’s stock. Stock market volatility can have a profound impact on his net worth, especially in the unpredictable world of tech startups.

The tech industry is known for its rapid changes, and Kalanick’s fortune is tied to the success of his investments, which may rise or fall with market trends.

Legal Battles and Controversies

Kalanick’s tenure at Uber was marked by controversies, including legal disputes related to intellectual property, workplace culture, and his leadership style.

These challenges had the potential to impact his net worth, as lawsuits and scandals often lead to financial settlements and legal fees.

However, Kalanick’s ability to bounce back from such setbacks has been a defining characteristic of his financial journey.