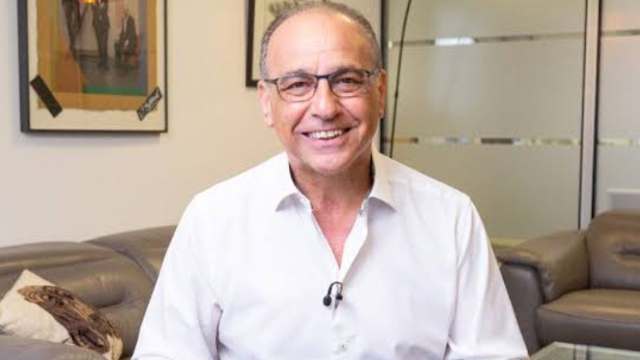

Theo Paphitis is a prominent British entrepreneur with a remarkable net worth estimated at $300 million. His wealth stems from a diverse portfolio of retail ventures and successful television appearances, particularly as an investor on the well-known series “Dragons’ Den.”

His business acumen and charismatic presence have made him a household name in the UK, especially in the realms of retail and entrepreneurship.

Early Life and Education

Born on September 24, 1959, in Limassol, Cyprus, Paphitis moved with his family to Manchester, England, at a young age.

His childhood was marked by a struggle with dyslexia, which presented challenges in traditional education but ultimately fueled his entrepreneurial spirit.

He quickly gravitated toward business, running his school’s tuck shop, where he first tasted the thrill of commerce.

After moving to London, Paphitis attended Ambler Primary School and Woodberry Down Comprehensive School.

He embarked on his professional journey as a tea boy and filing clerk at a London insurance broker, but he found his true calling in retail while working as a sales assistant for Watches of Switzerland at the age of 18.

His passion for the retail industry grew, leading him to sell commercial mortgages for Legal & General and eventually establish a property finance company with a friend.

Building His Fortune

Paphitis’s major breakthrough came in 1994 when he began his involvement with the stationery retailer Ryman.

After the company faced bankruptcy, he seized the opportunity to purchase it in 1995. Under his leadership, Ryman was revitalized through improved supplier relationships and strategic management practices.

He introduced innovative changes, such as a mail-order catalog and an online presence, which greatly expanded the company’s reach.

Following his success with Ryman, Paphitis acquired the UK and Ireland franchises for La Senza, a women’s lingerie retailer.

His expansion efforts included establishing sub-franchises throughout the European Union. In 2006, he sold his equity stake in La Senza for approximately £100 million, further bolstering his financial standing.

In 2011, he launched Boux Avenue, a lingerie brand with a focus on contemporary styles, which quickly gained traction across the UK.

Paphitis also acquired Robert Dyas, a hardware retailer, in 2012, adding to his already extensive portfolio. Each of these ventures contributed significantly to his net worth, showcasing his ability to identify and capitalize on market opportunities.

Football and Media Ventures

Beyond retail, Paphitis has had a notable presence in the sports world. He served as chairman of Millwall Football Club from 1997 to 2005, where his leadership saw the team reach the FA Cup Final in 2004.

His tenure was marked by efforts to combat football hooliganism, earning him respect within the sport. He also holds a position as a director and part-owner of Walton & Hersham Football Club.

Paphitis’s foray into television began with his appearance on the BBC reality show “Back to the Floor” in 2000.

However, he gained widespread fame as an investor on “Dragons’ Den,” where he appeared for nine seasons. His insightful critiques and keen investment strategies resonated with viewers and entrepreneurs alike.

His television career also includes projects like “Theo’s Adventure Capitalists,” which explored business opportunities in emerging markets, and “Britain’s Next Big Thing,” a behind-the-scenes look at successful UK brands.

Personal Life and Lifestyle

Theo Paphitis married Debbie Stocker in 1978, and together they have two sons and three daughters.

The family resides in Weybridge, Surrey, enjoying a comfortable lifestyle that reflects Paphitis’s financial success.

He is known to have a passion for cars, owning a collection that features personalized license plates such as “RYM4N,” showcasing his playful approach to his wealth.

Despite his considerable fortune, Paphitis remains grounded, often reflecting on the challenges he faced early in life and how they shaped his approach to business.

He emphasizes the importance of hard work and resilience, traits that have undoubtedly contributed to his impressive net worth.