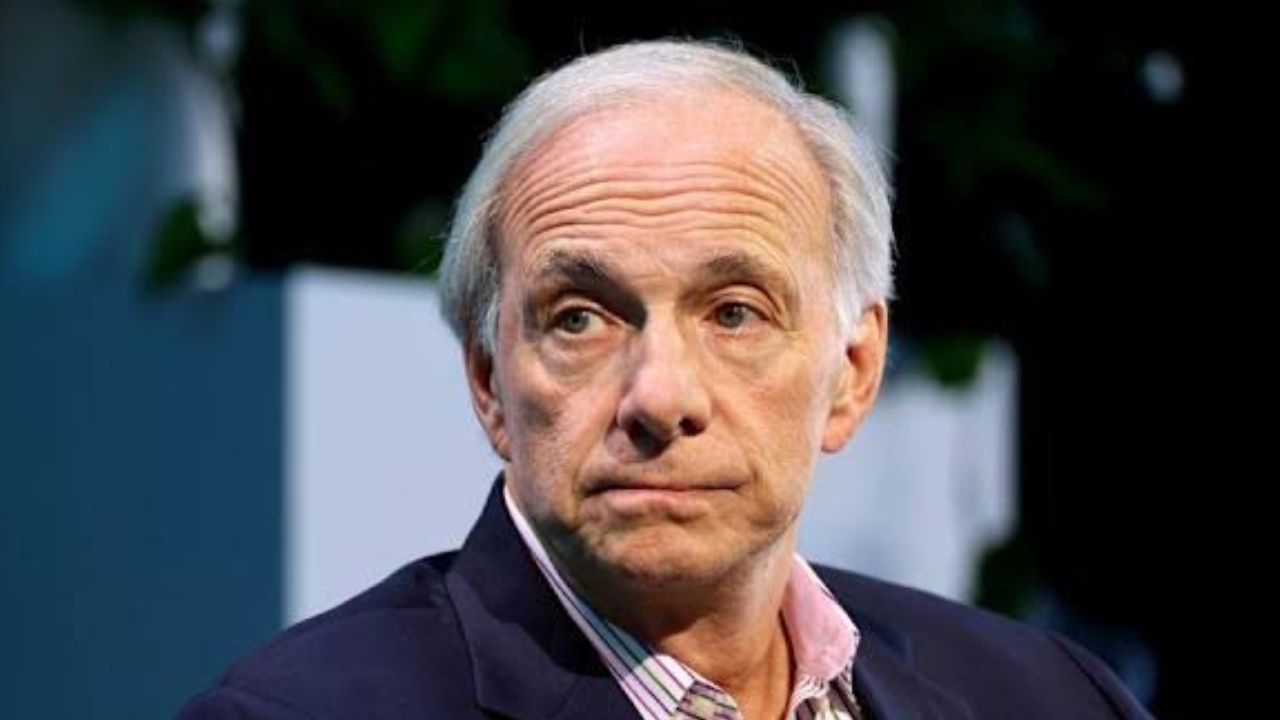

Ray Dalio is the founder of Bridgewater Associates, the world’s largest hedge fund, which has grown to manage $112 billion in assets. Dalio’s wealth of $14 billion places him among the wealthiest people on the planet, ranking him #160 globally as of April 2025.

His fortune primarily stems from his creation of Bridgewater, which he founded in 1975 after earning his MBA from Harvard Business School.

He started the hedge fund with a modest beginning, launching it from a two-bedroom New York City apartment.

Over the decades, Dalio’s innovative approach to economic research and hedge fund management transformed Bridgewater into a financial powerhouse.

Bridgewater Associates: The Journey to the Top

Dalio’s hedge fund is known for its groundbreaking approach to market strategy. Under his leadership, Bridgewater grew from a small operation to managing more than $112 billion in assets, making it one of the largest and most influential hedge funds globally.

This impressive success in the hedge fund industry directly contributed to Dalio’s multi-billion-dollar fortune.

Although Dalio stepped down as CEO in 2017 and retired from his role as co-CIO in 2022, his long tenure and his strategic decisions helped build Bridgewater into a financial behemoth.

The firm’s culture of “radical transparency,” which Dalio pioneered, has been a significant factor in Bridgewater’s success.

This philosophy encourages open debates and discussions at all levels of the organization, creating a unique environment that fosters innovation and critical thinking.

As the firm continues to thrive, Dalio’s wealth has continued to grow, cementing his position as one of the world’s most successful self-made billionaires.

Also Read: Drew Barrymore Net Worth 2025: Career, Salary & Personal Life

The Evolution of Dalio’s Net Worth

Dalio’s net worth has been a direct reflection of his ability to successfully navigate and manage economic cycles.

From its humble beginnings, Bridgewater’s assets have consistently grown, propelling Dalio’s fortune higher year after year. Dalio’s success is built on his deep understanding of macroeconomic trends, which has allowed him to make lucrative predictions and investments throughout his career.

For example, Dalio’s early predictions about China’s rise as a global economic power and his insights into the financial crises helped him and his firm to generate massive returns during key periods.

Dalio’s wealth was also bolstered by Bridgewater’s clients, which include major institutional investors like pension funds, sovereign wealth funds, and central banks.

These entities entrust Dalio’s firm with their capital due to its track record of generating above-average returns, despite market volatility.

As these clients grew in number and size, so did Bridgewater’s assets under management and, by extension, Dalio’s personal wealth.

The Philanthropic Legacy

Beyond his financial success, Dalio is known for his philanthropic contributions. Through Dalio Philanthropies, he has donated over $1 billion to various causes.

His charitable work focuses on areas like microfinance, education, and economic development, with a particular emphasis on helping disadvantaged communities.

Dalio’s commitment to giving back has also seen him join forces with other influential billionaires in using donor-advised funds to maximize the impact of their charitable donations.

Dalio’s philanthropy is an essential part of his legacy. By leveraging his vast fortune for the greater good, he has impacted lives across the world, proving that his wealth is not solely for personal gain but also for the betterment of society.

Dalio’s Unique Investment Philosophy

Dalio’s investment approach and success are often attributed to his philosophy of blending economic research with money management.

His belief that economic research makes him a better trader has been a central tenant of Bridgewater’s strategy.

He has also famously stated that “pain plus reflection equals progress,” a mindset that has guided both his professional and personal growth.

His strategies of diversification and risk parity have been highly influential in the hedge fund industry, attracting a legion of followers and shaping global financial trends.

One of Dalio’s core principles is the use of data-driven decision-making, relying heavily on understanding macroeconomic trends and patterns.

His constant reflections on market dynamics and historical economic events have allowed him to successfully predict and capitalize on major market movements, resulting in consistent wealth generation for both himself and his investors.

The Personal Side of Dalio’s Fortune

Dalio grew up in a middle-class family in Long Island, New York. Despite his humble beginnings, he was drawn to the financial markets at a young age, even beginning his trading career at the age of 12.

His first exposure to the stock market came from the tips he received while caddying for golfers, which sparked his lifelong passion for investing.

Dalio’s wealth and success, however, haven’t come without challenges. He has openly discussed the difficulties he faced in his early years, including the 1973-74 stock market crash, which significantly impacted his financial standing.

Despite these setbacks, Dalio’s ability to learn from mistakes and adapt his strategies has been a defining feature of his career and financial success.

Dalio’s personal wealth journey also speaks to his resilience. He built his fortune by focusing on long-term strategies and making decisions that sometimes went against the conventional wisdom of the time.

This willingness to take calculated risks and innovate has been a key factor in his rise to billionaire status.

Looking Ahead: Dalio’s Future

With $14 billion in net worth, Dalio’s influence on the global economy, hedge fund industry, and philanthropy is far from over. Although he has stepped down from his day-to-day role at Bridgewater, his insights continue to shape the financial world.

Also Read: Peter Navarro Net Worth 2025: Career Details

In addition to his ongoing philanthropic work, Dalio remains an active voice in discussions about global debt crises, the rise of alternative assets like Bitcoin, and global economic trends.

As he continues to lend his expertise to various initiatives, Dalio’s legacy as one of the most successful investors of his generation is secure, with his wealth serving as a testament to his innovative thinking and financial acumen.

Dalio’s ability to predict economic cycles, coupled with his commitment to radical transparency and philanthropy, has not only made him a multi-billionaire but also one of the most influential financial minds of his time.