In the heavily fortified Green Zone of Baghdad, the Rixos hotel, financed by Qatar, emerges as a symbol of increasing investment interest from Gulf Arab states in Iraq’s economy.

With 470 luxury rooms and suites, it’s poised to host Gulf Arab monarchs and Middle Eastern delegates during an upcoming Arab League summit, reflecting Prime Minister Mohammed Shia’ Al Sudani’s push for more regional investment in an economy scarred by decades of conflict.

Iraq, an OPEC member, has experienced relative calm since defeating the Islamic State in 2017, despite sporadic violence, including attacks from Iran-aligned groups.

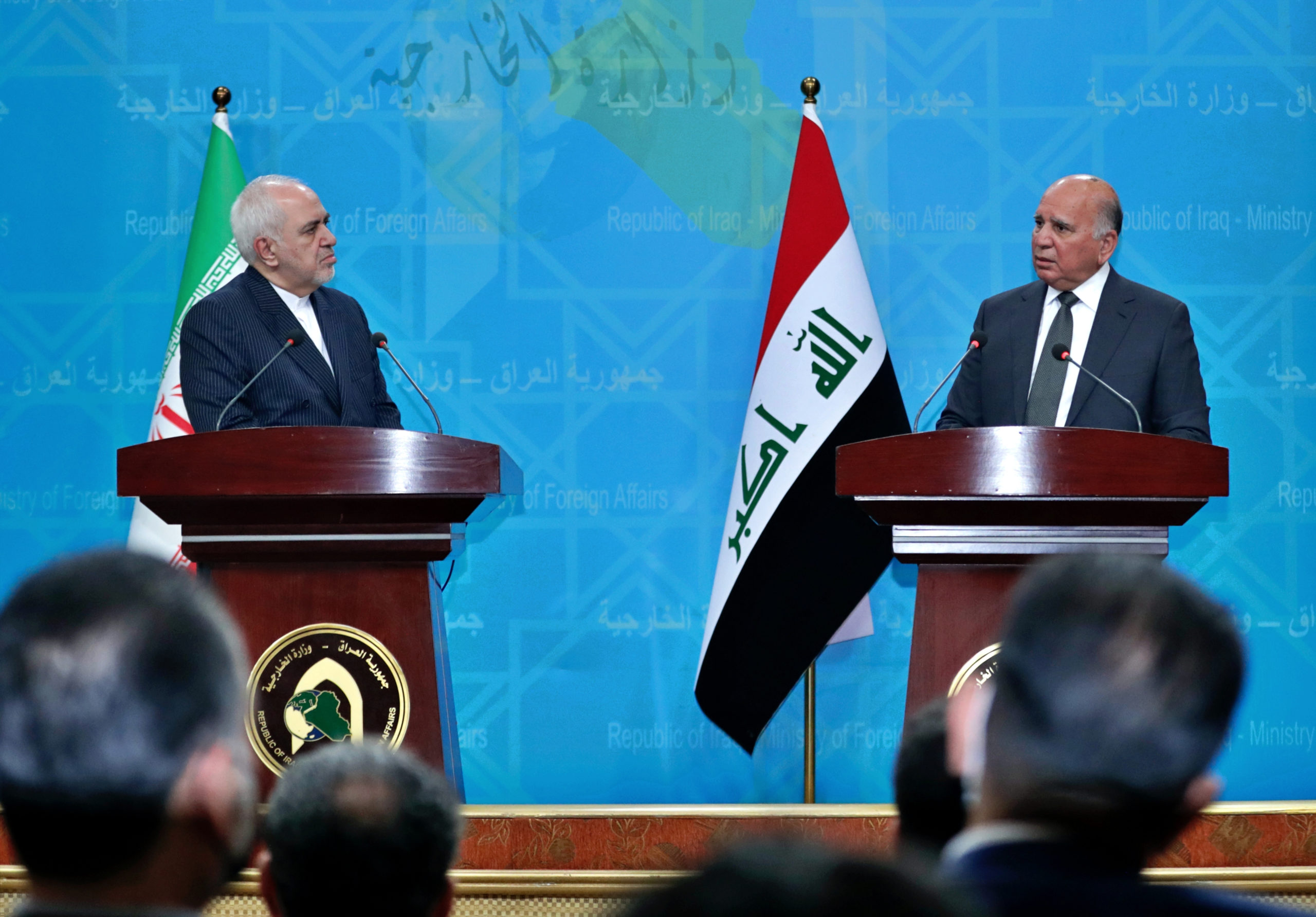

While China, Iran, and Turkey remain Iraq’s top trade partners, Gulf Arab states are pledging investments to counterbalance Iran’s influence in the region.

The improving ties between Iraq and Gulf Arab states signal a desire for cooperation, exemplified by Saudi Arabia and Qatar’s investments in Iraq’s economy.

Saudi Arabia has allocated $3 billion for investments in Iraq, while Qatar has signed agreements worth $7 billion for infrastructure development projects.

Iraq’s stability faces threats from rocket attacks by Iran-aligned armed groups and concerns over corruption and bureaucratic hurdles that hinder investment processes. Additionally, Iraq’s top court’s ruling on maritime borders with Kuwait deemed unconstitutional, strains relations with Gulf neighbors.

Gulf investors remain positive about opportunities in Iraq, recognizing its vast potential. The country’s strategic location and energy resources attract investments in various sectors, including infrastructure and energy.

The envisioned Gulf-funded projects, coupled with Iraq’s ambition to strengthen regional ties, present opportunities for economic growth and geopolitical realignment in the Middle East.