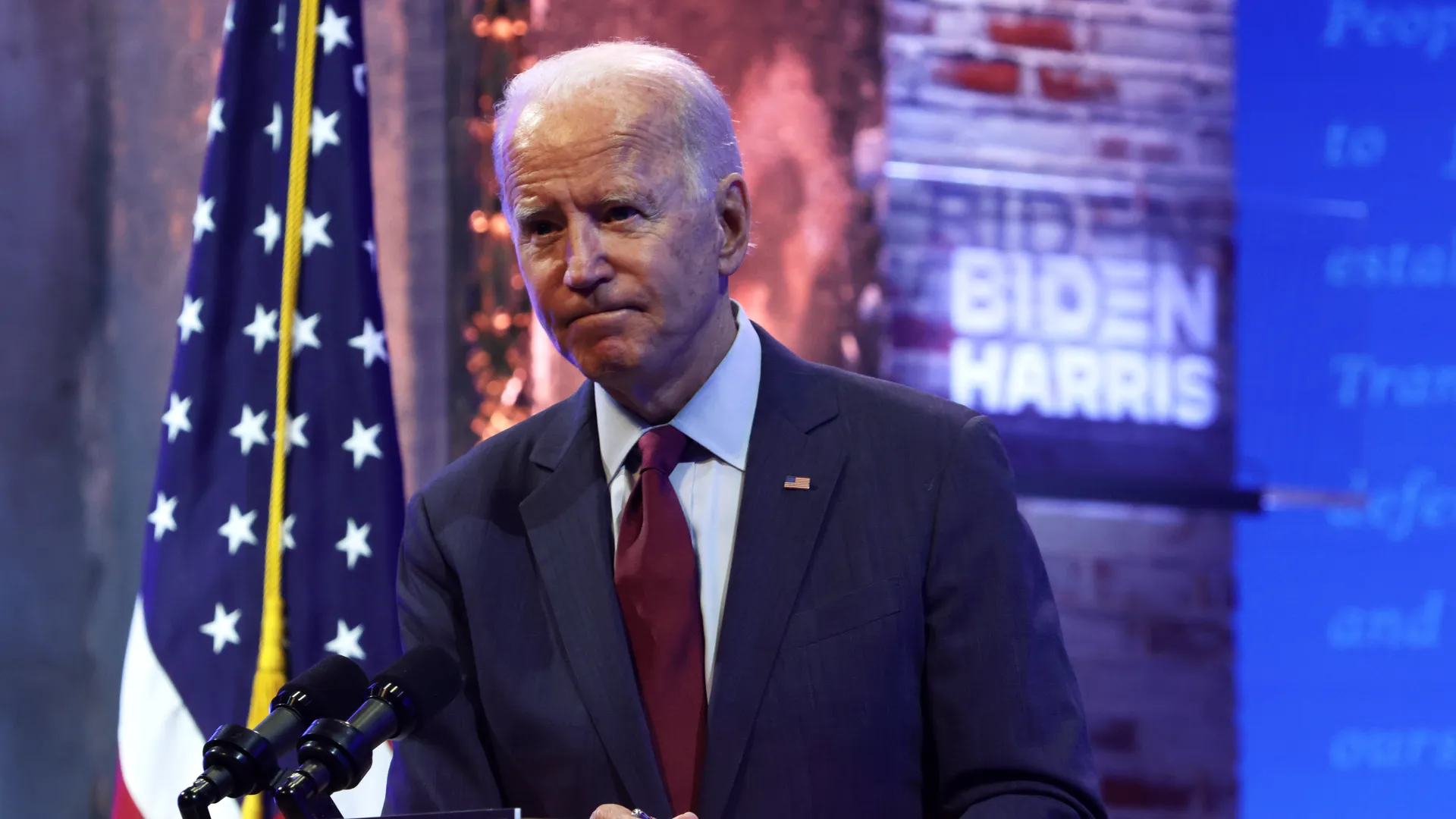

U.S. President Joe Biden and First Lady Jill Biden have made public their 2023 tax returns, revealing a 7% income increase to $619,976, with a corresponding 23.7% federal tax payment.

This disclosure comes as President Biden seeks reelection in 2024 and upholds the tradition of presidential tax transparency.

In contrast, former President Donald Trump, Biden’s potential opponent, broke with tradition by not releasing his tax returns during his presidency, citing ongoing audits. However, a House committee released redacted versions covering 2015 to 2020.

Trump’s financial matters, including a courtroom appearance on Monday, underscore the scrutiny surrounding his personal finances.

While Biden advocates transparency, Trump focuses on tax cuts enacted during his presidency, warning against potential increases under Biden’s administration without disclosing his own tax details.

Biden and the First Lady earned the majority of their income from their respective jobs, President Biden’s presidential salary, and Mrs. Biden’s teaching position at Northern Virginia Community College. Additional income came from investments, pensions, and book royalties.

Biden’s tax plan, to be addressed in a speech from his hometown of Scranton, Pennsylvania, is expected to emphasize higher tax rates for the wealthy, aligning with Democratic fiscal policy.

Vice President Kamala Harris and her husband, Douglas Emhoff, also released their 2023 tax return, indicating an income of $450,380, federal taxes of $88,570, and charitable donations totaling $23,026.

Biden and Harris’s tax disclosures aim to maintain transparency amid the electoral campaign, highlighting their financial accountability.