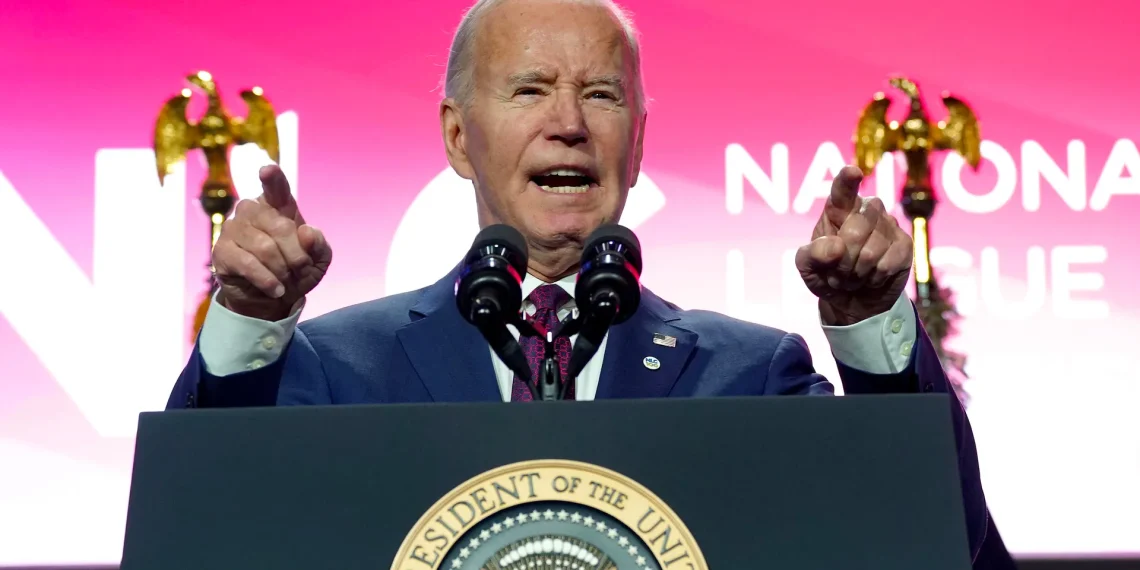

U.S. President Joe Biden unveiled a $7.3 trillion budget, outlining his vision for a potential second term and aiming to differentiate his economic policies from those of former President Donald Trump.

The proposal prioritizes tax increases on corporations and high-income individuals to address the deficit and fund new social programs targeting housing and childcare challenges, though its passage through Congress remains uncertain.

Biden’s budget for the 2025 fiscal year entails raising the corporate tax rate and implementing a minimum tax for wealthy individuals, alongside measures to negotiate lower drug prices. It also includes provisions for child tax credits, childcare initiatives, housing construction, paid family leave, and law enforcement enhancements.

The announcement comes amidst skepticism from Republicans, with House Speaker Mike Johnson criticizing the proposal for its perceived excessive spending and disregard for fiscal responsibility.

Biden, however, defended his stance, arguing for fairness in taxation and challenging Trump’s tax policies during an event in the election state of New Hampshire.

Despite Biden’s efforts to rally support, the proposal faces an uphill battle in Congress, with divided economic priorities complicating its path to approval. While Democrats aim to address social inequalities and invest in key sectors, Republicans remain wary of increasing government spending and advocate for fiscal restraint.

As the budget proposal becomes a focal point of political debate, its fate hangs in the balance, reflecting broader ideological divisions within American governance.

Biden’s push for tax reform and social investment sets the stage for a contentious legislative showdown, with the outcome shaping the trajectory of economic policy in the years ahead.