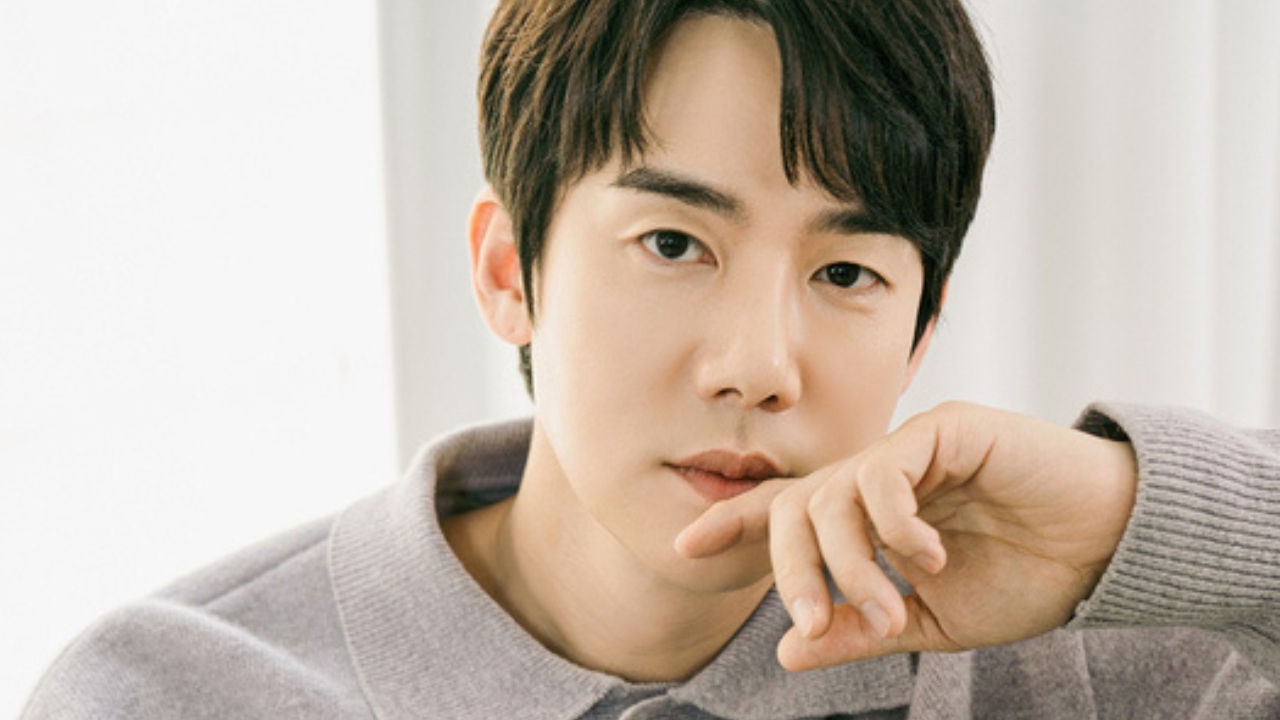

Actor Yoo Yeon Seok has been hit with a 7 billion KRW (~$4.8 million USD) tax penalty, following an extensive audit conducted by South Korea’s National Tax Service (NTS).

The penalty includes unpaid income tax, which was revealed through a detailed investigation into the financial activities of his one-man agency, Forever Entertainment, where Yoo Yeon Seok serves as CEO.

Tax Audit and Dispute Over Tax Laws

The audit led to an additional tax imposition on the actor, which he is currently contesting. In January 2024, Yoo Yeon Seok officially filed for a follow-up tax review, arguing that the penalty stemmed from “differing interpretations and applications of tax laws.”

His legal team is actively working to reduce the tax amount during the ongoing review process.

Agency’s Response and Industry Trends

When asked for a statement regarding the controversy, KingKong by Starship, Yoo Yeon Seok’s agency, responded that they are preparing an official statement to clarify the situation.

This news follows a broader trend of increased scrutiny on high-profile South Korean celebrities regarding tax compliance.

Recently, actress Honey Lee also underwent an intensive audit, receiving a 6 billion KRW (~$4.1 million USD) tax penalty. However, her team strongly denied allegations of tax evasion, confirming that the additional tax had already been fully paid.

Impact on Yoo Yeon Seok’s Career

As Yoo Yeon Seok continues to dispute the findings of the audit, concerns remain over potential damage to his reputation.

Similar tax-related controversies have led to brand endorsement losses and public scrutiny for other celebrities.

The final outcome of the tax review process could determine whether his financial penalty will be reduced or if further actions will be taken against him. Stay tuned for updates as KingKong by Starship releases its official statement on the matter.